The Portland Press-Herald, that jewel among newspapers, has run another op-ed from me, bless their heart:

This newspaper recently reported on a study, commissioned by the Greater Portland Board of Realtors, that purported to show that Portland’s rent control program had raised property taxes for house owners.

The Press-Herald astutely notes that this report was released “as Portland property owners are receiving their new tax bills.”

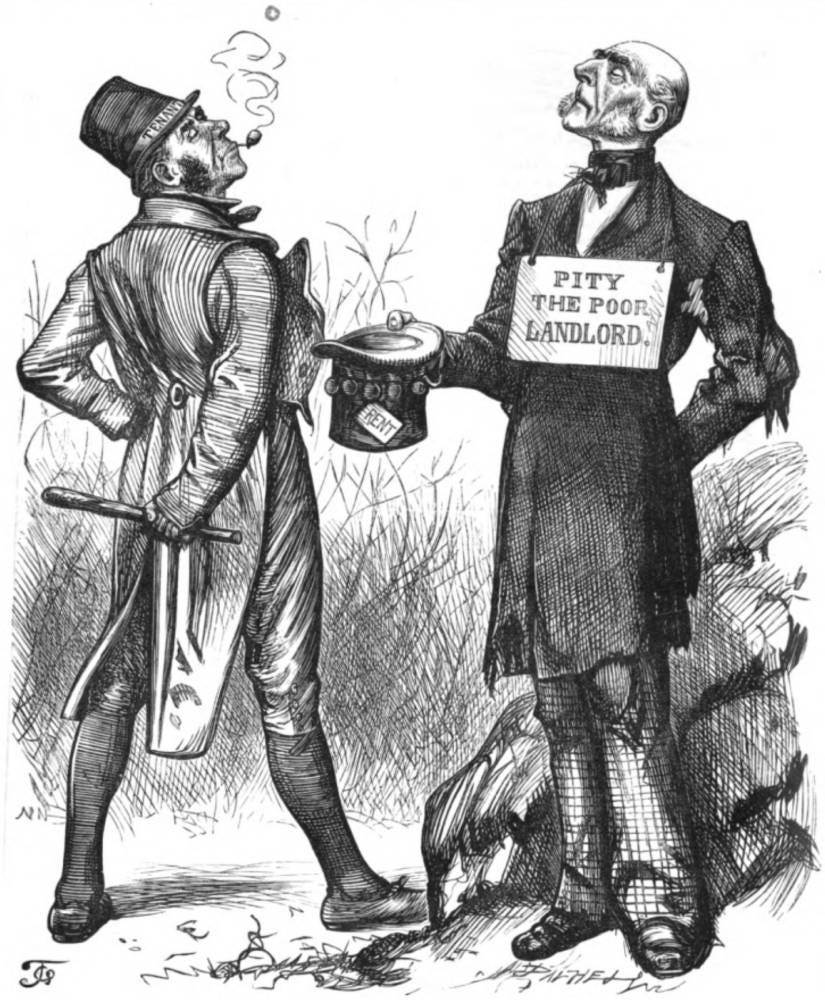

The political intent is obvious enough: drive a wedge between renters and owners, with a view to getting rid of rent control (which landlords naturally detest).

Owners, after all, know how much property tax they’re paying, because they get a bill. And nobody likes taxes. Renters may not even realize that they’re paying property tax at all (it’s folded into the rent, like all the property’s expenses) and they certainly have no idea how much they’re paying, much less what share of the total tax nut they’re paying.

I personally am a renter and I like rent control very much. But still, facts are facts, if they are indeed facts, and so I looked into it.

The report is a fairly readable 20 pages, easily summarized. The landlords argue that rent control has diminished the value of rental properties, and since property tax is assessed on value, individual homeowners will have to take up the slack. Are the landlords right?

Let’s start with the basics: rents.

The listing firm Renthop provides some nice charts, listing rents for various categories of apartments in Portland, from 2015 until late 2024. Across all categories, from one to four bedrooms, the picture is similar: rents burbled along, with some variation from year to year, but no overall trend, from 2015 to 2020. Then they collapsed, because of COVID.

In 2021, they began a dramatic climb to historic highs, consistently and considerably more than the previous average. They’ve more or less plateaued there since, with the usual year-to-year variation. Note that this dramatic rise in rents occurred after Portland’s rent-control program was put in place.

Rents are obviously the basis of the value of rental properties. The landlord report tells us that Portland landlords realize between 6% and 9% annual return on the investment in their properties, which isn’t too shabby for a low-risk investment.

But the point is, the higher the rental income stream, the more valuable the property. People will pay more to buy a building that nets $200,000 a year than for one that gets $100,000.

The landlords’ data on rental property values, unsurprisingly, more or less follow this relationship. For one category of properties, with five or more units, the sale price per square foot showed a significant increase from 2020 — the apocalyptic Year of Rent Control, remember — to 2022.

Prices have sagged a bit since then, but not back down to pre-2020 levels. Looks to me like a boom followed by a correction.

The landlords also give us a nice chart of the share of taxable value in Portland that rental properties constitute, comparing 2021 and 2025. In every category, that share has increased.

Meanwhile, what’s happened with owner-occupied house prices? Everybody knows they’ve gone through the roof, pun fully intended. According to another chart the landlords provide, house prices have increased 86% since 2019, while rental properties with five-plus units, over the same period, have “only” increased 52%. That’s still a pretty healthy bump over six years. I’d be a happy investor with appreciation like that, on top of the 6-9% annual income.

The landlords would argue that, without rent control, rental property prices (and rents, of course) would have gone up even more than they did. Because, well, because. Self-evident,right? In fact, there’s no way of knowing whether this would have been the case. The report essentially assumes what it sets out to prove.

In summary, this landlord report is self-discrediting baloney. But if it sets owners and renters at each other’s throats, perhaps it will have served its purpose.

© 2025 The Portland Press Herald

Superb

Take that from a veteran

real estate value bulldozer